Email: [email protected]

House buying costs involve much more than just the purchase price. Things like private mortgage insurance, property taxes, HOA fees, homeowners insurance and other expenses can add up quickly, making it even more important to prepare for them.

To make sure you're ready to handle the upfront costs and ongoing expenses of buying a house, here's what to expect:

There may be many costs involved with the loan application process, including fees due at closing. In general, closing charges vary from two to five percent of the home purchase value. Depending upon the lender, you can still find lower fees by shopping or by negotiating lower fees.

If you see any fee you feel is excessive or unneeded, like application fee or mortgage loan lock fee, contact your lender to get additional information.

Depending on your closing costs, the first months may involve some ongoing costs. During the second year, you may have to pay additional expenses, such as local property tax.

If your home is part of an association, you'll have to pay your dues, which range from just one dollar to hundreds per month depending upon how the association provides facilities.

Home inspections are generally optional, but are extremely recommended. A home inspection typically varies in cost between $500-$800, and can provide information about the condition of the home that will guide you to the best deal. Additional costs may be charged when a pest or radon inspection is necessary or advisable.

The more you know what to expect when it comes to expenses, the better you can budget and plan for your future as a homeowner. Check with your mortgage lender about any fees you're unsure about, and remember these additional costs of buying when creating a budget for your homebuying process.

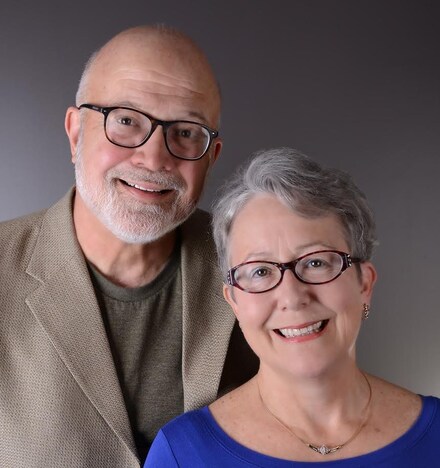

Holder Home Team

I am licensed in both Massachusetts & New Hampshire and Judy takes care of the creative part of things and together we are experts in this local area, we bring a wealth of knowledge and expertise about buying and selling real estate here. It's not the same everywhere, so you need someone you can trust for up-to-date information. We are eager to serve you. Here are some of the things we can do for you:

Find Your Next Home

You need someone who knows this area inside and out! We can work with you to find the right home at the right price for you, including all the neighborhood amenities that matter - not to mention the essential criteria you have for your ideal home

Sell a Home

When it's time to move, you need someone who will advertise your home, show to prospective buyers, negotiate the purchase contract, arrange financing, oversee the inspections, handle all necessary paperwork and supervise the closing. We can take care of everything you need, from start to close.

Consult on Home Selling Tactics

Oftentimes buyers don't visualize living in your home the way you do. We can make your home attractive to its ideal audience - which can help you get top dollar. Things like staging the home, making repairs or minor improvements, or even simply painting the walls can be the difference between a home resting on the market and one that's sold fast.